January 1st half is invariably the time of the year when everyone young and old starts scrambling to look out for tax saving options. Generally, the reminder for the salaried class is when their employers start requesting for tax declaration evidence shared way back in April last year – otherwise salary in hand is going to be less for the next 3 months!!

The ideal way is to plan this year on year and preferably at the start of the fiscal year itself, but this of course is the more boring option for majority and hence the last minute scramble. Though there are multitudes of options available today (apart from the insurance policies or the Home Loan toh hai na default option), the likelihood of someone choosing the incorrect option is very high. Why? Cos employers ko certificate evidence kal dena hai!

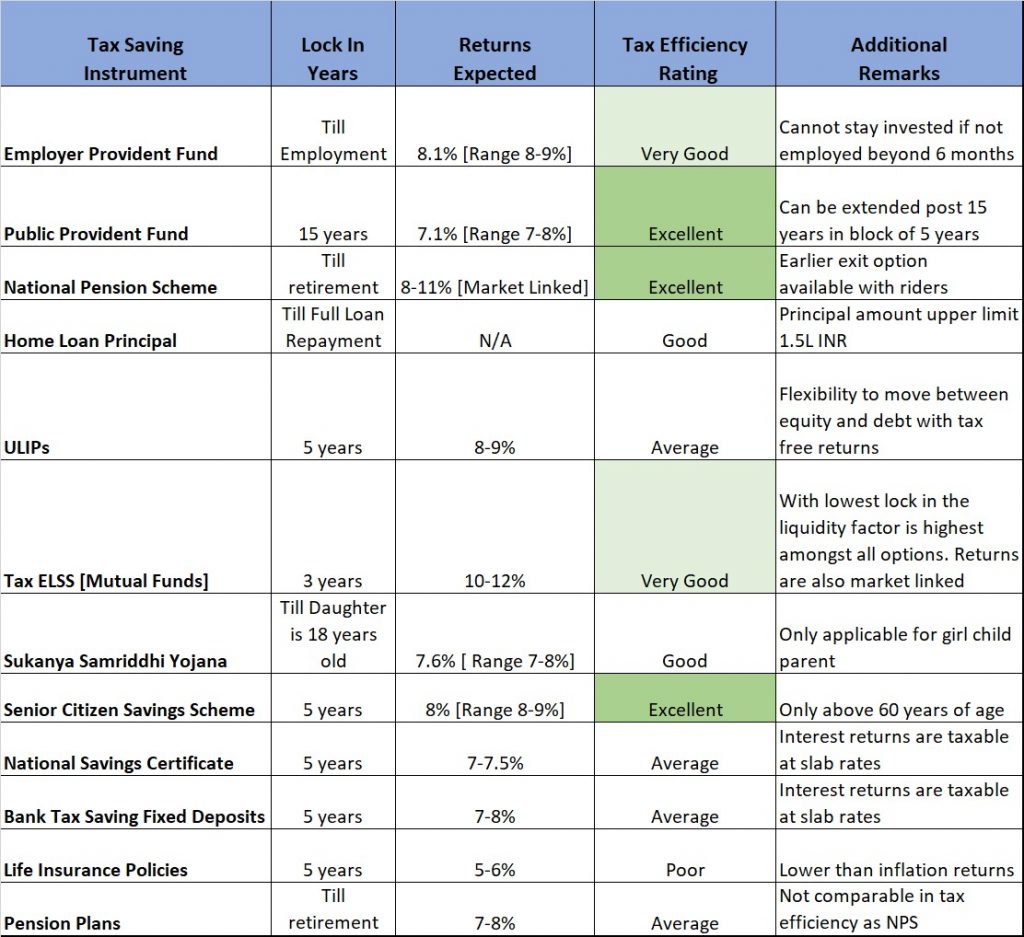

Here are some quick references for what option would work the best as per your financial situation or needs,

For the Age Bracket [20-40]

Ideally at this age bracket your options can be adjusted into a mix of short term [for liquidity] and long term [for better tax efficiencies]. Ideal options can be chosen are from below,

- Employer Provident Fund or Voluntary Provident Fund – This is a must for all salaried class and should be opted as much as possible for the compounding magic to work at time of retirement.

- Public Provident Fund – Provides the triple E benefit of Entry Exempt, Interest Exempt and Exit Exempt – no taxation but with a lock in of 15 years and extending option.

- National Pension Scheme – Pension scheme which provides a long-term safety net post retirement and worth allocating some amount each year as soon as you start your career. Lock in period is till retirement age [minimum of 55] but provides an option to mix equity debt allocation as well as per your age bracket on manual or auto mode as preferred.

- Home Loan – Both principal and interest are ideal ways to save tax if already availed. Though the interest option has a upper limit of 2L INR.

- ULIPs [Unit Linked Insurance Plans] – Better option than NPS since the lock in period is lesser, taxation is zero for switching between equity and debt but ideal only if held long term till completion of policy to reap benefits. Also, it may not necessarily provide you with the life cover you need since investment is directly related to coverage.

- Tax ELSS Funds – Mutual fund route to save tax is ideal if you don’t want to lock in your money for a very long term like above options. Its minimum of 3 years post which you can withdraw the amount anytime. Taxation of course needs to be managed for any gains above 1L INR during withdrawal which is taxed at 10%

For the Age Bracket [40-60]

By this age generally you are earning enough for your own provident fund contribution itself taking care of the major part of the 1.5L INR upper limit under Section 80C and if you still are owning a house on loan then the rest would be taken care by the principal amount of the loan. Ideal options to be chosen during this period would be,

- Employer Provident Fund or Voluntary Provident Fund – This is a must for all salaried class and should be opted as much as possible for the compounding magic to work at time of retirement.

- Sukanya Samriddhi Yojana Scheme — applicable for individuals with daughters younger than 10 years, the interest earned is tax free similar to PPF contribution. This account can be opened for maximum 2 daughters but overall contribution cannot exceed 1.5L INR limit. Lock in till daughter reaches age of 18.

- National Pension Scheme – still a valid option in this age bracket since it provides a mix of equity and debt albeit conservative approach is recommended above the 40-year age.

- NPS – additional contribution of 50K under section 80CCD (1B) – nominal amount which can be added over and above the 1.5L INR mark

- Home Loan – Both principal and interest are ideal ways to save tax if already availed. Though the interest option has a upper limit of 2L INR

- Tax ELSS Funds – Mutual fund route to save tax is ideal if you don’t want to lock in your money for a very long term like above options. Its minimum of 3 years post which you can withdraw the amount anytime. Taxation ofcourse needs to be managed for any gains above 1L INR during withdrawal which is taxed at 10%

For the Age Bracket [60+]

At this age bracket unless you have ongoing income via business or other avenues the income generated is significantly lesser and the default tax saving option should be chosen with capital preservation in mind than return generation. Reason is the interest income being generated is most likely used for daily, monthly expenses and any volatility is unacceptable at this stage of your life. Some common options you could opt,

- Senior Citizens Savings Scheme (SCSS) – One of the best schemes for senior citizens (above 60 years bracket) with healthy return of 8% currently. With many inherent advantages of safety, consistent high returns the only downside is it has an upper limit of 15 L. Ideal way to utilize would be to open an account each in own and spouses name to avail full benefit. Defence personnel can opt any age [not 60 and above] as long as they fulfill other criteria’s of retirement, voluntary or otherwise.

- National Savings Certificate (NSC) – Probably an option once the SCSS limit is exhausted. Interest rates are lower and again lock in of 5 years is applicable.

- Tax Saving Bank Fixed Deposit [TAX FDs] – probably a choice which should be at the bottom of priority but nonetheless applicable due to safety nets. Tax on interest is applicable as per the tax slab of the individual so eventual return may not beat the inflation.

Other common options that can be utilized across any age brackets are the Life Insurance Policies and Pension Plans but their returns traditionally have been much lower than inflation rates so should not be preferred over above options specifically to save tax. Their utility is exactly what they are for which is Insurance of life and accumulating pension corpus. Below table should be a good guideline whilst you make this important decision each year,

Beyond all the Do It Yourself (DIY) actions above ideal scenario would be to always consider these investment decisions aligning to your personal financial planning. Contact a personal financial professional or advisor who would be the best judge to look at this holistically and suggest the right vehicle as per your financial health and status each year. With the lock-in period, varying returns and taxation laws being different in each area it would be prudent to take professional guidance in these matters. So, April is the correct month to plan and act, not January

– Prasad Iyer

[Certified Financial Planner – CFP CM]