Decoding Mutual Funds – Definition of Market Caps, Benchmark, Comparison Criteria

Yeh Mutual Funds exactly Kya Hai? This is a very common question I receive while doing financial awareness sessions or client meetings. With rapid marketing and DIY advertisements plus peer pressure in some instances a lot of people today either have misconceptions about mutual funds [‘you will lose money for sure’ attitude] or limited knowledge [‘it will double your money bro’ attitude]. While both scenarios are the extremes there is always a middle ground and balanced approach you need to take for everything in life. Mutual funds are actually simplified products best suited for retail who are aspiring to be part of a nation or world’s economic growth but don’t know exactly how to participate via stock buying from the primary or secondary market. This blog is an attempt to explain the main components for generic retail investor which should suffice understanding the product as they start investing into it. For more intricate nuances around categorizations and variations please feel free to refer to AMFI website for extensive research.

What is a Mutual Fund?

Mutual funds, simply put, is a pooling of money from investors and investing it in equity [stocks/unlisted or listed companies], bonds [corporate, state govt or central govt] and government securities. Each mutual fund has a scheme objective and is professionally managed by a fund manager who oversees the allocation and changes as per these objectives set. The gains generated from this collective investment scheme are distributed proportionately amongst the investors, after deducting applicable expenses and levies, by calculating a scheme’s “Net Asset Value” or NAV. In return, mutual fund charges a small fee which is governed and regulated by the Securities and Exchange Board of India [What is SEBI ]

Types of Mutual Funds

The normal retail investor is most interested in equity mutual funds which directly invests in stocks [e.g Reliance, Asian Paints, Zomato, PayTM etc.], businesses which they see or touch and feel in their everyday life. Anything apart from this like bonds, debt funds starts dwelling in to unknown territory for them and they try to avoid it completely. This approach is actually detrimental to long term wealth creation since real wealth is always created only by way of diversifying risks [not keeping all your eggs in one basket]. Basic knowledge of types of mutual funds and their objectives if known goes a long way in helping you make the right decision.

There are various ways to categorize mutual fund schemes and at a high level all funds are either of the below 2 categories,

Categorization basis Organization Structure

Open-ended schemes: These schemes allow you to invest and redeem on ongoing basis at the current NAV [e.g: active funds like PPFAS, HDFC Large Cap etc.].

Prime Investment Criteria: Compounding and Appreciation

Fund Examples: Axis Bluechip, Mirae Emerging Asset etc.

Close-ended schemes: These schemes have fixed maturity date and generally utilized for instruments like tax-saver fund majority of the times. These lock-in periods can vary from 90 days to 5 years depending on the schemes and intended to work in favor of the retail investor by allowing uninterrupted investment journey throughout their tenure. [e.g: Kotak Tax Saver, Nippon Tax Saver]

Prime Investment Criteria: Tax Planning, Govt Bonds, Long term Investments

Fund Examples: Mirae Tax Saver, Quant Tax Saver etc.

Categorization basis “Where they Invest”

Equity Mutual funds: Equity mutual funds are funds where the fund manager directly invests in to stocks of particular companies in the listed stock exchange. The overarching principle for this option would be growth and dividends accrual over a period of time as the underlying economics of the company and where [sector, countries] where it operates. [e.g: Reliance, Asian Paints, HDFC Bank etc.].

Prime Investment Criteria: Compounding and Appreciation

Fund Examples: SBI Emerging Equity, HDFC Small Cap etc.

Debt Mutual Funds : Debt funds are generally fixed-income securities and their overarching theme for investments would be in to bonds, securities and government treasury bills. They invest in various fixed income instruments such as Fixed Maturity Plans (FMPs), Gilt Funds, Liquid Funds, Short-Term Plans, Long-Term Bonds and Monthly Income Plans etc. Since the investments come with a fixed interest rate and maturity date, it can be a great option for passive investors like Senior Citizens or Pensioners looking for regular income with minimal risks.

Prime Investment Criteria: Capital Preservation, Post Retirement Planning

Fund Examples: UTI Dynamnic Bond, Nippon India Strategic Debt Fund etc.

Hybrid Mutual Funds : Or alternatively known as Balanced Funds focus on mix of stocks and bonds to reduce volatility to the long term and short term performance of the fund. They can be both fixed ratio or flexible ratio funds in terms of 60% equity and 40% debt or vice versa. Hybrid funds are suitable for investors looking to take more risks for ‘debt plus returns’ benefit rather than sticking to lower but steady income schemes.

Prime Investment Criteria: Capital Preservation, Retirement Planning, Medium Risk Profiles

Fund Examples: UTI Dynamnic Bond, Nippon India Strategic Debt Fund etc.

Solution or Sector Oriented Funds : These funds typically focus on a particular theme (sectoral theme like infrastructure, technology etc.) or timeline (pension, post retirement etc.) and focus on only those type of companies or stocks or investments which can provide returns mapping to the theme. They generally are high risk funds or high volatile funds depending on the theme chosen. Timing the entry and exit becomes very important in these funds

Prime Investment Criteria: Alpha Returns Generation, Riding the Macro economic Cycle or theme

Fund Examples: SBI Magnum ESG, Sundaram Financial Opportunities, Canara Robecco Consumer Trends etc.

Index Funds : Index funds are the simplest form of funds in that they only copy the underlying benchmark index stocks they are mapped to like Nifty 50 stocks, Sensex 30 stocks, BSE Midcap Top 100, NSE Top 200 etc. Since there is not much study required into choosing the stocks of these funds they are generally the least expensive fund manager fees wise and very popular amongst the passive investor segment. The downside of-course is the earning potential over longer period of times with professional fund management and alpha generation is not available. One false assumption generally by retail clients is they are safer than equity stocks or other mutual funds. This is untrue cos they have same risks as their underlying benchmark which are made up of stocks.

Prime Investment Criteria: Low-Cost Option, Non-Researched, Pensioners Choice

Fund Examples: UTI Nifty 50, HDFC Index etc.

While the above categorization should help you at high level understanding what mutual funds are the very expanse of financial services and fund management styles entails various categorizations possible. Some of the more popular ones are below for reference,

Risk Based Funds Categorization: Very Low-Risk, Low-Risk, Medium-Risk, High-Risk.

Specialized Mutual Funds: Index Funds, Funds of Funds, Emerging Market Funds, International Funds, Real Estate Funds, Commodity Focussed Funds, Exchange Traded Funds

Common Definitions

Market Cap: Market capitalization shows the size of the company and its aggregate value.

Market Capitalization = (Total no of outstanding shares) * (Price of one share)

Outstanding Shares refers to all shares currently owned by stockholders, company officials, and investors in the public domain.

Take an example of Reliance Industries as of today,

Market Cap = (Total no of outstanding shares) * (Price of one share)

Reliance Market Cap = 61,71,002 * 2345 = 144,710.11 Lacs = ~14.41 Billions INR

Large, Mid and Small Cap

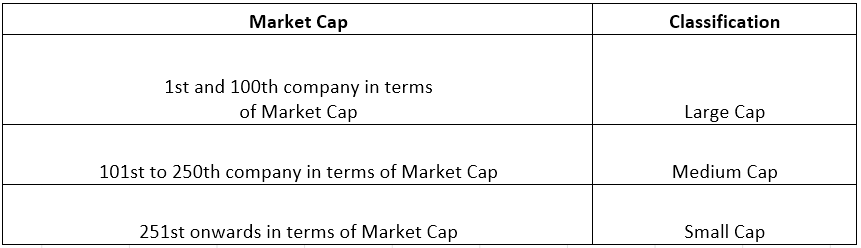

There is no hard and fast rule for categorization of the companies based on the market capitalization. If you refer to different financial websites, the range of market cap will vary for different capitalization. In general here is the commonly accepted classification of companies based on the market capitalization in Indian stock market. (as per SEBI guidelines)

Other Common Terms

Flexi Cap: This primarily refers to mutual funds which invest across all the Large, Mid and Small at a flexible ratio. This is a very common fund choice for long term investing and for investors who don’t want to worry about specific market caps and its volatility (mid, small caps) or its lower alpha (large caps) e.g: Kotak Flexi Cap, Canara Robecco Flexi Cap etc.

ELSS: Equity Linked Saving scheme is generally a tax savings scheme with a lock in period of 3-5 years useful to save tax under Section 80C.) e.g: Quant Tax Plan, HDFC Tax Saver etc. More on tax saving options covered in our other blog [Bachao Humhe – Tax se !!! – kyronconsultants.com]

Corporate Bonds: A very common Debt fund which invests into a mix of Government securities or bonds like REC, NHAI [atleast 80% as a ] and also private corporates to generate returns little over inflation rate with minimal risk and sovereign guarantees. e.g: Nippon India Bond, Axis Corporate Bond etc.

Liquid Funds: These funds are actually a debt fund which invest in fixed-income instruments like commercial paper, government securities, treasury bills, etc. with a maturity of up to 91 days. Generally investors can get their withdrawals processed within 24 hours. These funds carry the lowest interest-rate risk in the debt funds category and very commonly used to park funds for short period to preserve capital.

Benchmark: Benchmark is the reference or criteria of comparing any mutual funds return against the theme its investing.. for e.g: A Large Cap mutual fund would always be compared to NIFTY 100 TRI benchmark returns, a flexi cap with Nifty-500 TRI, a small cap fund against Nifty – 250 TRI

AUM: Assets Under Management is the total amount that is being managed by the fund manager under the mutual fund. This is the actual invested and appreciated amount of the investors put together in the mutual fund. Usually new funds would initially start with few hundred crores and over longer period of time with appreciation and fund performance balloon easily to few thousand crores.

NAV: Net Asset Value is the actual price of 1 unit of a mutual fund. Most mutual funds when they come out with new offering peg this at INR 10 face value. As the performance of the mutual fund grows the NAV grows too. This though should not be directly coorelated to the price of a mutual fund meaning less NAV is not better than higher NAV. A higher NAV may infact reflect growth over long years. This though should be compared to benchmark and other factors including some highlighted below before choosing any fund.

XIRR: Extended Internal Rate of Return is the return calculation of investments or redemptions done at varied times of varied amounts as well. This is the ideal criteria to apply to understand your returns in a mutual fund where the investments and redemptions happen not in a fixed pattern. Unfortunately many of the broker portals do not showcase this prominently for your portfolio as of today. Many financial advisor portals and apps do showcase this by default and should be utilized to thoroughly understand your portfolio performance.

Absolute Returns: This is a simple calculation done on your portfolio from investment to gain or loss perspective. This gives the larger picture but not specifics of exact yearly or accrued performance over a period of time. This though is a good indicator of how far you have come in your investment journey when looked at from multi year perspective.

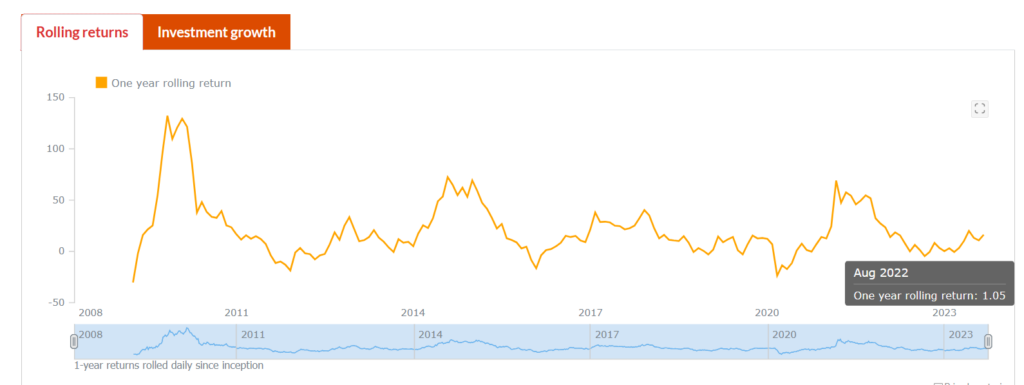

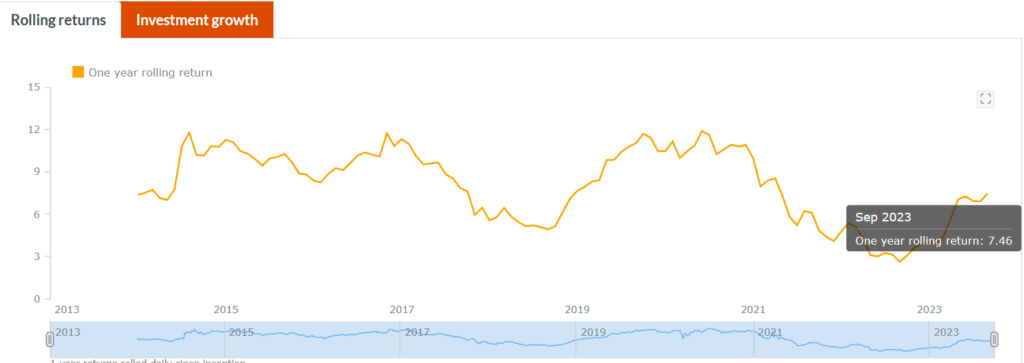

Rolling Returns: This is a very important metric generally used by financial advisors while evaluating any mutual fund returns. What it reflects is a point to point return calculated over the entire life cycle of the mutual fund. More than anything else it displays the consistency of the fund manager approach and churn rate or volatility of the fund. Higher churn rates mean higher transactions charges which affect the NAV of any fund but gets hidden. Understanding this return is critical while choosing any mutual fund for long term investing.

Expense Ratio: This is the total expense charged by any mutual fund and includes the fund manager and distributor fees. Generally regular plans expenses would be higher compared to direct plans with underlying assumption of the distributor providing professional advice and guidance as part of recommendation or creation of your portfolio. A DIY investor can opt for direct plans though all initial investors would be better off taking professional guidance as they start their journey to understand the nuances before attempting on their own. One very critical aspect to keep in mind in equity investments is “time” is the actual currency and not the “money”. A few years lost making below average returns cannot be regained. Likewise more the number of years you have in hand guarantees an above average returns if invested in disciplined manner without interruptions or redemptions.

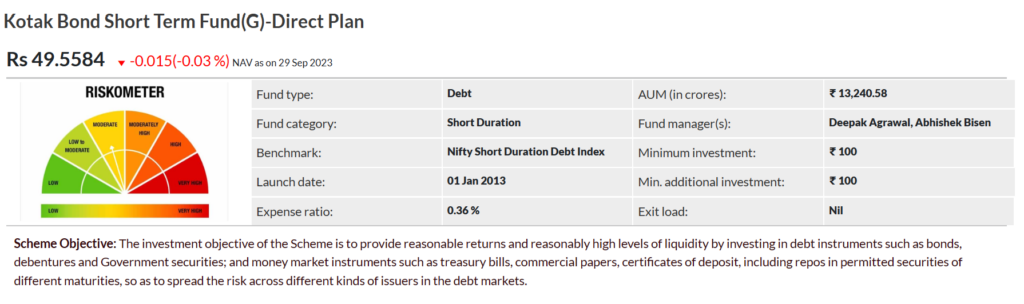

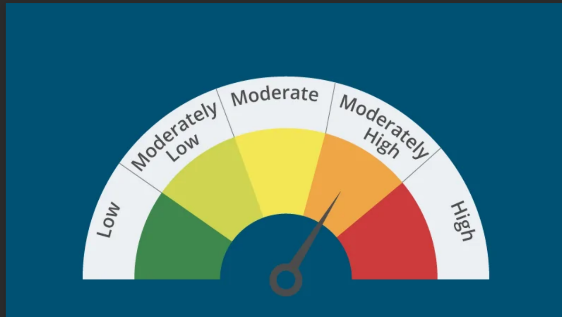

RiskoMeter: A riskometer is a pictorial representation of the risk a mutual fund carries. The graph is designed according to the Association of Mutual Funds in India (AMFI) guidelines. Though not complete in its purpose for customized requirements of individuals, what it successfully highlights is the volatility an investor should expect with the fund. Lower Risk will always mean average inflation adjusted returns and Higher Risk would map to above average returns. Both are essential based on who is investing and for what purpose basis their risk profile. A senior citizen with no income should ideally opt for Low Risk funds or a balanced approach while a young investor who has just started his career can easily digest higher volatility in his fund choices as long as it delivers above average returns over long periods of time. A prudent financial advisory would always ensure a mix of risk basis life stage of their clients.

Rebalancing becomes an important aspect at regular block of intervals [common one being age criteria of 35, 40, 50, 55, 60 years etc.]

Let’s take 2 examples across different categories of Mutual fund to understand the above definitions better.

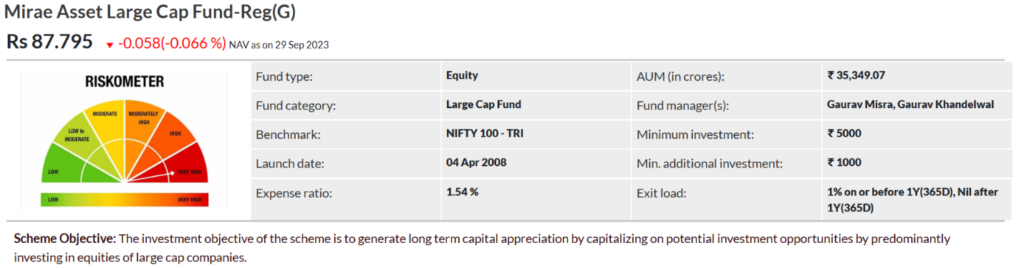

Mirae Asset Large Cap Fund – Regular Plan

As you can see for Mirae Asset Large Cap the NAV as of 29 Sep 2023 is 87.795 with an expense ratio of 1.54%. Its rolling return displayed of 1 year period is 1.05% and this can be computed for various cycles and time periods. The AUM of the mutual fund which is total asset under management is 35,349 INR Crores as of the date. Its investment returns compared to its benchmark is displayed over multiple years as below

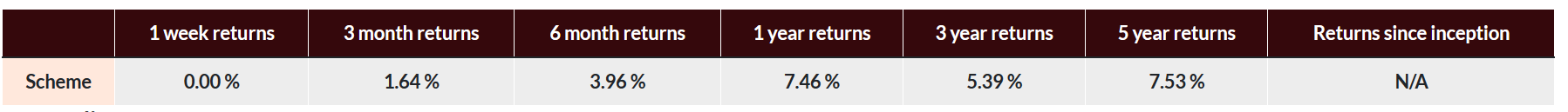

Kotak Short Term Bond Fund – Direct Plan

Kotak Bond is a Debt fund with rolling returns of 7.46% as of Sept 2023 with a AUM of 13, 240 Crores, expense ratio of 0.36% and with a moderate risk profile as per Riskometer. It’s a capital preserving fund which provides returns adjusted over inflation over longer period of time as can be seen in the table below

If you are a beginner, the above information should suffice to understand the basic nomenclatures used related to mutual fund investments and make you a little more confident discussing or considering this asset class to achieve your financial goals. Any more feedback please do reach out to us directly at info@kyronfinserv.com or leave a comment at the bottom of this blog.

Disclaimer: All the funds mentioned in examples are randomly chosen and not any recommendations. Please engage your financial advisor or mutual funds distributor before making any investments.

Image and Data Source: Various social media sites including Money-Control, AMFI etc.